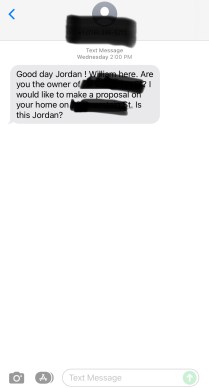

Commonly, Selenid and I will receive unsolicited mail or messages from others looking to buy one of our rentals. Like the text I recently received below. However tempting it may seem, it’s actually pretty easy for us to resist these messages to sell our investment properties.

But why is it that we don’t want to sell our investment properties? (And put aside the fact that this message is likely from a wholesaler and we would only sell through our investor real estate agents.)

It’s an important question to consider. Without an answer, receiving inquiries like this can lead to confusion about what the right next step is. Confusion can lead to making a bad long term or short term decision with a big impact on your wealth.

Thankfully, Selenid and I are very clear on our real estate investing plan which makes the decision easy.

Top 3 reasons we don’t sell our investment properties

Let’s examine.

1. We are buy & hold investors

This is the biggest reasons. We know exactly who we are as real estate investors. It’s even written in our actual financial plan that you can review in full here.

Selenid and I have chosen to focus on Buy, Rent, & Hold multifamily investment properties.

There are a number of reasons that we decided on each of these sub-strategies:

- Buy – Well, you can’t own real estate without buying it so there’s step #1

- Rent – By renting the properties, we can have the tenants pay our mortgage with their rents. In addition, since the total rents exceed the mortgage/tax/insurance/etc. payments, we keep the extra money as cash flow.

- Hold – The overall real estate market is not unlike the stock market. They both go up and down in the short term. However, in the long term, they generally go up. So, in buying properties that cash flow and holding them for a long time, we can increase the chance that the property gains value by the time we eventually plan to sell it.

- Multifamily – By increasing the number of units under one roof, you decrease the cost per unit, increase profit in general, and make your business more efficient. Right now, we are starting with 2-4 unit properties but will go bigger in the future.

To sell our properties goes against the third component of our investment strategy. By selling, we would lose two very important things that real estate gives us to build our wealth:

- Cash flow (here are 4 reasons that cash flow is king)

- Long term forced and market appreciation

Let’s break this down even a bit further…

Losing cash flow for us is a big deal. Our whole goal for real estate investing is to generate passive leveraged income that will gain us financial freedom – the ability to work because we want to, not because we have to.

A lump sum – which is what we would gain from a sale – does not do that for us. In fact, by investing in real estate, we are actually trading a lump sum (in the form of a down payment, rehab costs, etc) for future leveraged cash flow.

To sell our investment properties would just reverse everything we had worked for!

Secondly, we never rely on market appreciation when evaluating or buying real estate. We focus on cash flow. But we still strategize to maximize any potential benefit of forced appreciation.

And just like the overall stock market, the best way to see your real estate investments appreciate is to wait. Let time do its thing.

2. It would be a bad tax decision

Real estate investors love to talk about the tax advantages of real estate investing. And I can’t complain, because I talk about them as well. However, I am quick to say that tax advantages are just one of the many reasons to invest in real estate. And investing just for tax benefits doesn’t make a lot of sense.

But, with that said, Selenid and I certainly use the tax benefits of real estate investing to our advantage.

As a quick review…

One of the great things about real estate investing is that you can write off passive “paper” losses against the profits of the investment property.

These passive “paper” losses come largely in two forms:

- Expenses from running the property and

- Depreciation

The government and IRS says that each real estate property loses value each year. In fact, after 27.5 years, the value of any property is $0 in the IRS’ eyes. And this 27.5 years resets every time a property is sold or changes hands.

So, each year, every property you own loses 1/27.5 of its value. This loss in value is the depreciation of the property and is considered a passive loss. You can then use this passive loss to offset passive income – like rental income. You can do this even without REPS.

This is a huge advantage. Especially when you realize that your property didn’t actual lose value but provided immense value as a source of rental income and possible appreciation!

But wait, theres more! You can accelerate this depreciation…

By hiring a cost segregation company to “cost segregate” your property, you can divide items and parts pf your property that actual depreciate to $0 in much less time than 27.5 years.

After the cost segregation is done, you can take advantage of forced appreciation to claim much more depreciation of value for your property. You can use these massive passive losses to offset more passive gains or carry them forward to future tax years.

The problem is that most people don’t have huge amounts of passive income. But they have huge amounts of active income, like from W2 jobs in our case.

This is where Real Estate Professional Status comes into play

By qualifying as REPS, you can now take these massive “paper” depreciation losses and not just offset passive income, but also offset active income like from your W2 job.

In this way, you reduce your taxable income for that tax year immensely and owe way less in taxes!

This is the tax strategy that Selenid and I use with Selenid qualifying for REPS.

However, a key to this strategy is that you do not sell your investment properties after cost segregation and accelerated depreciation

When you accelerate depreciation, you lower your tax basis in the property. Essentially this means that when you do sell the property, your depreciation (the tax benefits you harvested) are recaptured. So, when you sell, you pay much more in taxes than if you had not accelerated depreciation.

The way around this is to either:

- Hold your properties and don’t sell or

- Sell via a 1031 exchange (a whole separate topic, but basically you sell and buy a property of equal or greater value through a 1031 exchange company with a set time frame and thus do not pay taxes on the sale)

Selling one of our properties without a 1031 exchange after accelerating depreciation would not make sense for us.

3. It goes against our “why”

Eventually, we will likely sell one of our investment properties. As noted above, it will likely be via a 1031 exchange.

But we do not take this decision lightly. And we would never do it off of a whim. The reasons above still stand in explaining why.

But another really important and not to be overlooked reason is that we have a strong “why” for investing in real estate.

Our “why” can be broken down into two parts:

- To help us achieve financial freedom but also

- To create stable, clean, and affordable housing for those who otherwise may not be able to afford it while building up our community

Selenid and I have looked at a lot of rental properties. Unfortunately, they are not all run well. We all hear terrible stories of tenants living in poor conditions and in disrepair due to irresponsible property owners.

Our goal is to do the exact opposite. We want to provide safe and stable housing. We often rent to those who otherwise could not live in such housing due to financial or other circumstances. That’s why we vet prospective tenants ourselves so that we can look beyond credit scores to find the right tenants.

This is an important responsibility to us and not one that we easily pass off.

Watch Jordan’s Masterclass Webinar on The 12 Steps to Financial Freedom for Physicians here!

Reasons to sell your investment properties

As I mentioned above, there will likely come a time when we sell a rental property. And there are numerous good reasons to do so including but not limited to:

- Significant appreciation

- Need for lump sum due to change in financial circumstances

- Loss of desire to manage (or hire management) for properties

- Inheriting a property that you don’t want to manage

- And more

However, these are the big 3 reasons why Selenid and I do not sell our investment properties. And they should be major factors that you consider before selling yours!

And here are additional resources to learn more about real estate investing for physicians!

- The Real Estate Flywheel Effect for Physicians

- A Real Estate Investing Guide for Physicians

- How Doctors Can Decide If They Are a Better Active or Passive Real Estate Investor

- Buying, Renovating, and Renting Out an Investment Property

- 5 Biggest Downsides of Real Estate Investing and How to Overcome Them

What do you think? Have you sold an investment property? Why? Have you resisted selling a property? Why? What is your real estate investment strategy? Let me know in the comments below!