Yesterday (April 2023), I finished the process of refinancing my private student loans for a second time. I’ve been on the look out for a good opportunity to do this and it finally arose. So, let’s examine the 3 biggest reasons that I decided to refinance my private loans and how I did it.

For a refresher on my first go around to refinance my private loans, check this out.

3 biggest reasons I decided to (re) refinance my private loans

In no particular order…

1. My private loan rate went up to 7.5%

When I refinanced initially, I chose a 5 year repayment period since I planned (and have) paid them off aggressively ahead of schedule. For this reason, I also chose a variable interest rate that started at 3.5% with a 0.25% reduction for automatic payments.

This was great when rates were low. And in general, this strategy makes sense. But as we all know, rates rose a great deal over the past 18 months. With no signs of slowing down.

As a result, my variable rate now lives at 7.5%. My daily interest amounts to about $9/day. And this is much higher than I like.

Even though I still pay off about 3x the minimum amount every month, I wanted to get a better rate in the meantime.

2. I get cash back for refinancing

I used Credible to refinance my private loans previously.

Credible is a student loan refinancing marketplace. Basically you enter your personal and loan information and they will find a multitude of offers for you. Then you can sort by loan duration, interest rate, and rate type. And finally you chose the best refinancing option for you.

And once you do, not only do you get a great new private loan refinance package. But Credible will also give you up to $1,000 cash back! The exact amount depends on the amount of loan you are refinancing. But for most doctors refinancing student debt, you will be at the $1,000 level.

Plus Credible has really great customer service and a very east user interface. So it’s a real no brainer for me.

3. The status of my federal student loans changed

I have around $268,000 of federal student debt from college and medical school.

While I have not been paying these off currently since they are on 0% forbearance, my debt pay off plan calls for aggressively paying off these loans. And that is what I have always planned to do as soon as the forbearance lifts.

However, things recently changed. Due to Temporary Expanded Public Service Loan Forgiveness, my previous 7 years worth of deferment (due to my ignorance during training) now count towards federal loan forgiveness. So I am, as I write this, 14 months away from forgiveness. I got lucky. No other way to put it.

So, my plans have changed as well. Because remember, if you refinance federal student loans, you lose out on any potential forgiveness! Whereas before it made sense to refinance my federal loans after forbearance lifts to get the better rates to aggressively pay them off, it now makes sense to pay minimal income based payments for 14 more months until the rest are forgiven.

And that is what I will do.

I previously planned to wait and refinance everything together – both private and public loans. But this change in the plan for my federal student loan debt led me to accelerate the timing of my private loan refinance.

How I refinanced my private student debt again

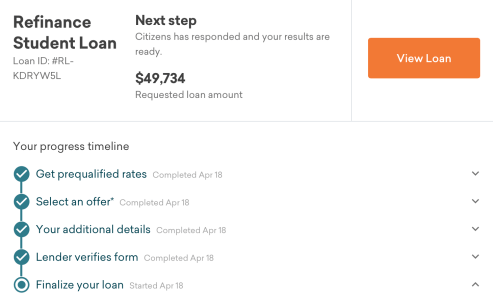

To begin, I just went to Credible and entered my personal (name, etc) and loan (amount, etc) information. For reference, I refinanced the remaining $49,734 of my initial $175,000 refinanced private debt.

They then presented me with a bunch of possible refinancing options which I immediately sorted for the shortest term possible, 5 years.

Given the current interest rate environment and the fact that I plan to pay this off in a year or less, I stuck with fixed interest rates this time. And the best interest rate offer came from Citizen’s Bank at 5.5%. Interestingly, I refinanced through Citizen’s the first time as well.

So, I selected that option and was directed to a log-in page for Citizen’s Bank where I uploaded some documents like my previous tax return and pay stub for income verification. Less than a day later, my loan was approved. And I already arranged automatic payments to take advantage of a 0.25% rate reduction.

Now, I just wait for them to pay off my previous loans and start up the new account. And to receive my $1,000 cash back.

Pretty easy.

And there you have it!

Refinancing your loans presents huge advantages in the right situation. For me, making the decision to refinance my private loans again made a lot of sense by lowering my interest rate and giving me cash back.

Plus it fits right into my plan for aggressive private loan pay back despite changes in my federal loan payment plans.

If you think it could make sense for you, learn more here. Keep in mind that you can refinance your loans as many times as you want. But remember, if you have federal loans and are seeking forgiveness, do not refinance!

And once you have your debt pay back plan in place, it is time to start using compound interest in your favor by investing!

- Stress Free Stock Market Investing Is Easier Than It Seems!

- A Real Estate Investing Guide for Physicians

- How Much Is Enough Retirement Savings?

What do you think? Have you refinanced any loans? What was your experience like? Would you do it again? Let me know in the comments below!