As of March 2022, Selenid and I closed the deal on our fourth investment property!

We are super excited about this property and actually got it rented out and cash flowing less than 24 hours after we closed! This was a new record for us.

The search for this one started looking at two other properties in the South Buffalo area with our investor real estate agents. Neither of these two properties were fits for us.

However, when leaving the second one, our agent mentioned that another realtor had a new listing nearby that wasn’t going up until tomorrow. He called the other realtor and got us in!

It is a large duplex with a 3 bedroom upper unit and 4 bedroom lower unit. We loved it and then loved it even more after our analysis. So, we put an offer in and got it!

With that said, as I usually do, I want to walk through each stage of the deal with you all.

First, a primer…

As always, before going into the investment property deal analysis itself, I’d recommend you read this post on my analysis strategies first if you haven’t already.

But, I’ll give a quick recap as a refresher.

- We invest in multifamily cash flowing rental investment properties using a Buy, Fix, Rent, and Hold model

- To screen investment properties, I use the 1% rule (Monthly rent/Purchase price >/= 1%)

- If it meets criteria, I move forward to more analysis

- If it doesn’t meet criteria, I move on to another property

- To analyze investment properties, I use cash-on-cash return (Annual Net Income/Money Out of Your Pocket >/= 10%)

- If it meets criteria, I lock up the property by placing an offer based on your criteria

- If it doesn’t meet criteria, I move on to another property

- To valuate investment properties, I use NOI (Annual Income not including financing)

- Estimated Sale Price = NOI/X% (based on local market data, usually 8%)

We are going to pick things up in the analysis stage. My wife and I had already screened this property and it more than met the 1% rule. So we moved forward for further in depth analysis.

And now for the investment property deal analysis!

Stage 1 – Initial Investment Property Deal Analysis

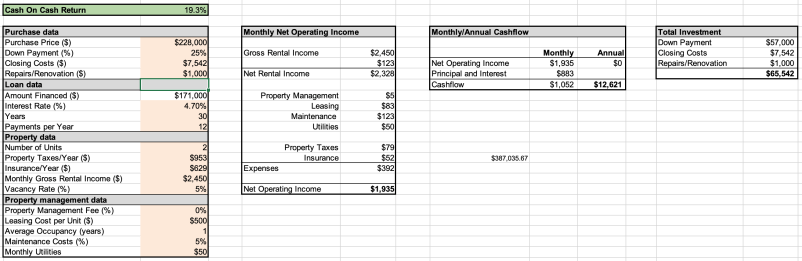

Here’s what our initial analysis looked like:

This analysis was based on the following assumptions that we made after walking through the property with our investor real estate agent:

- The asking price was $200,000; we knew this was listed wayyyyy below market value and was done so to incite a bidding war by the listing agent. We estimated we would need to pay around $225,000 to get the property and get the cash flow that would make it worth it. Lastly, we like to increase out offers a bit above “round numbers” so we settled on $228,000.

- We estimated about $1,000 in necessary renovation/rehab. Really there was nothing much to fix since it was all just renovated.

- The units were both vacant. Based on our currents rents, our gross monthly rent for all units each month would be $1200-1250/month.

- We got our mortgage terms and closing costs for our lender. Our interest rate increased a bit to 4.7%, as rates have recently risen.

- The insurance terms were from our insurance broker and the taxes were from the county open access database.

- Utilities were estimated based on our experience as we would only be responsible for water. Each tenants would pay their own gas and electric.

- Property management and turnover fees were based on known fees based on our prior properties using self management with Hemlane as our management platform.

- Keep in mind that we knew from our previous experience with our other 3 properties, that self managing with a platform like Hemlane is super easy (contact me for a referral). (Here is a primer of successfully self managing a property.) So, our property management fee dropped to 0.1% ($2). We also knew leasing costs for each unit would be less, around $650.

- Vacancy rates and maintenance costs are general estimates.

Based on this, the cash-on-cash return was only an estimated 19.3%!

Based on our goal of 10% or greater cash-on-cash return, this was a no-brainer!

But we still had to look for hidden value…and a sidebar about turnkey properties:

- This property was pretty turnkey. Now usually we don’t go for turnkey as much of the value is already taken out by the flippers. But that is why deal analysis in this way is so important. We found that even despite this fact, we could get this property to cash flow really well!

Stage 2 – Investment Property Deal Analysis including Hidden Value

This is what our analysis looked like after we took into consideration hidden value that we identified in the property:

Let’s review what changed.

- Actually, not a ton changed. That’s again because a lot of the hidden value in this property had been tapped by those who flipped it. This is a downside of buying turnkey properties in general. So, our excitement with the property is really just based off of the initial cash flow rather than a hidden cash flow after tapping into hidden value. This is why our selection of a purchase price that worked for the cash flow we wanted is so important!

- Regardless, as we did more research, we felt pretty strongly that our initial rent estimates were overly conservative. We estimated for a 4 bedroom unit we could get $1400 for the area and that for a 3 bedroom, we could get $1275. Our second rental property is just a few streets away so we had good rent estimates from that.

So, in this stage of deal analysis, our estimated cash-on-cash return was 23%!

Needless to say, we were excited

We placed our offer and learned that there were many others.

First, we made our offer more competitive by waiving the inspection clause and also offering $15,000 in escrow or earnest cash. This is basically the money we put down once the contract is signed. Putting a larger amount signifies that you are very serious about the deals and have good cash reserves, etc.

And now, this is where our investor agents went to work!

It came down to 2 offers, ours and another. The other offer was for $263,000…$63,000 above asking price! This is obviously absurd and we would not increase out offer above $228,000 when the seller asked.

However, the other offer was an FHA loan. Our agents negotiated quickly with the seller’s agent highlighting three main points:

- The property likely would not appraise at the high offer’s price, leading to an issue with closing

- That he had worked with and closed multiple deals with us and we were serious buyers who kept our work and closed deals

- Our loan was conventional versus FHA which can be more challenging to close

Based on this, we got the offer accepted and went under contract!

We moved into the closing phase, but we did something different…again

Normally, we would have moved into an inspection phase after making our offer with an inspection contingency.

But, I mentioned above that we waived our inspection contingency in the offer to make it more competitive.

And I know what you are saying! “Wait, Jordan…didn’t you just say you made a mistake by doing this with your previous property??”

The answer to that question is a resounding “yes!” But, that experience did teach us a lot of what to look for and with this property we did feel comfortable doing it again.

Related Post:

How To Actually Buy A Real Estate Investment Property

It is a calculated risk that we took. I’ll keep you posted on how this works out…

A new addition to the investment property deal analysis

Some of you may have noticed a new number included on my deal analysis spreadsheet:

This number represents the value of the property based on an income based model after forced appreciation using capitalization rate and NOI. If this seems confusing, read this post!

I usually include this number in my calculations personally but haven’t always put them in these posts.

But I want to make sure to include it here because it demonstrates the dramatic impact that forced appreciation can have on your property as well as just illustrate again how real estate investing, done wisely, is a wealth accelerator!

Deal analysis after closing

I think one of our super powers is to get an investment property rented out quickly after closing to get the cash flow started.

In this case, we started advertising the two units about 5 days before our closing. In the ad, we stated we would be having an open house for viewing in the evening on the day of our closing. It was easy to get these ads out because the sellers had staged the house and included great pictures in their listing. So we just used these pictures in our ads. It doesn’t always work out this way.

We got about 25 hits from interested tenants that confirmed. About 15 of these actually showed up to the showing. We had multiple interested parties apply online and chose who we felt were the best fits.

Lastly, during our walkthrough, we did identify a few minor cosmetic fixes we wanted to do. I texted out contractor who gave me a quote and this increase our repairs budget from $1,000 to $1,500.

In the end, our deal analysis looks like this:

Final cash on cash return is equal to 22.8%!

Take Away(s)

I hope that this exercise has demonstrated again how property deal analysis is critical for success as a real estate investor. But, it is also a process and evolves through the acquisition of a property.

Again, the reason for this is that the real estate market is not efficient. In this case, the CoC met our goal from the beginning. But as we’ve seen with property #2 especially, this is not always the case.

Your CoC should reach your goal after taking into consideration tapping hidden value. This can feel scary because you have to take a leap of faith. But, the important thing is that you are conservative in your estimates.

Also, as long as the investment property is cash flowing in your most basic estimate before taking into account tapping hidden value, then you are ok even in the worst case scenario.

The other thing that this deal really illustrates is just how important it is to have a great investing team!

Ready to learn more about investing in real estate?

- How To Actually Buy A Real Estate Investment Property

- Powerful Case Study of Passive Hustle in Real Estate Investing

- How to Pick the Right Real Estate Market

- The Complete Physicians’ Guide to Real Estate Syndications

- Real Estate Investing: The Good, The Bad, and 50% Returns!

- How to Win the Fight Against Analysis Paralysis

What do you think? Have you invested in real estate? How have your investment done? Do you use the same analytics as I do? Let us know in the comments below!

Love the blog? Share with a friend and don’t forget to sign up for our newsletter mailing list below (under the comments) or to join our Facebook group of like-minded individuals on the path to financial well-being!