It’s been a bit since I’ve shared an update on my first real estate investment property. So I figure it’s about time. The focus of this real estate update is going to be on my ups and downs, wins and losses.

It’s been just about 3.5 months of having the property. The first half month was spent renovating and rehabbing. We had our tenants move in October 2020.

Here we go!

Up: Cash Flow

At the beginning of each month, my wife and I run the books. That will be a major focal point with this real estate update. We collect all expenses and income and calculate our profit. We just use Excel to do this. As of this writing, we have run the books on the first two months of tenants leases.

(You’ll notice for below, we just count the mortgage/principal with the first unit for simplicity. We also just include the escrow for insurance and taxes in the principal/interest since we pay it all with the mortgage.)

Here are the books for Apartment A:

And here is Apartment B:

And finally, the work shed we rent out to a third tenant:

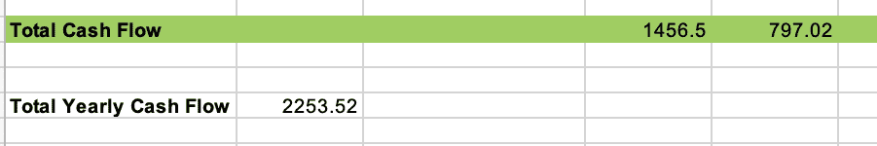

So, our monthly and total cash flow are:

Our estimated cash flow is 17.1%, calculate here.

Based on the two months, our expected yearly cash flow is 22.1%.

I am calculating this by taking our total cash flow and averaging per month ($2253.52/2) and multiplying by 12 months for a yearly total ($13,521.12).

Next, I divide this yearly cash flow by the amount of money that came out of our pocket to purchase/rehab/renovate the property ($61,113.23).

Our current cash flow at the time of this real estate update is thus projected at 22.1% (#13,521.12/$61,113.23).

This, plus the fact that we have forced over $100,000 in appreciation for the property, illustrates the awesome impact real estate can have on your portfolio!

(Refresher on how to calculate these metrics and why they are the best to use here.)

Down: Maintenance Costs

You can see in the Excel sheet for Apartment B that our maintenance expenses were over $350.

We actually budget 5% of monthly leasing costs to maintenance which comes to an estimate of $110/month for all units. So we were very over on just this one unit.

What happened?

Well, our tenants just moved from a hot climate locale to Buffalo. We have an older home which just has heat controlled from the lower unit. The upper unit, such as this one, would be heated passively. This is common for older homes in our area.

As most tenants are instructed, we told them that they may want to buy a space heater(s). Electricity is actually cheaper than gas so this is more cost effective for them anyway.

They bought, let’s just say, very inadequate space heaters. A cold spell hit in October. It was in the 30 degree range and they like the 80 degree range. They called and complained. After realizing the issue, my wife and I bought 2 large and energy efficient space heaters for the unit.

We easily could have told them tough luck and they are responsible. But we figured we could kill a few birds with one stone:

- Keep our tenants happy

- Buy space heaters that we own

- Improve energy efficiency

- Advertise that space heaters are included for subsequent tenants

Overall though, still a down area so far. Like all others, this real estate update will be honest and I’ll do my best to avoid putting on the rose-tinted glasses.

Draw: Self management

Selenid and I are automating our property and will likely continue to do the same for our next properties for now.

Translated: We self manage using an online platform called Hemlane. We work hard to establish systems that allow for easy management.

Honestly, I wanted to call this section a Win. But I call it a Draw because I’m sure a lot of people would argue that I am more active in management than they would like. For me, it’s about what I expected.

I’ll list here what I have had to “manage”:

- Tenant called that electricity was not working in a few plugs. I texted the electrician who went over that day and fixed it. He invoiced me. Done.

- The whole space heater issue discussed above. This was the most annoying thing so far. It required me going to the unit, diagnosing the issue, going to Lowe’s to buy the heaters, and then installing them. A pain but probably only 3 hours of my time.

- Upper tenant blew a fuse with the space heaters and some other things he plugged in. I went and showed him how to reset the circuit.

- Upper tenant blew fuse again. Ugh. He texted me and asked permission to reset. I texted back “Yes.” That’s all.

- The lower tenant messaged that the kitchen link was occasionally blinking. I went to diagnose the issue and found an LED light that was burning out. It was one that required changing the whole fixture. I went to a hardware store and someone showed me an LED fixture with replaceable bulbs. He showed me how to install it. A couple weeks later Selenid and I went and installed it in about an hour. I could have just called the electrician but we wanted to learn to do it. I actually got a lot of satisfaction doing this. That’s the surgeon in me. (Note: This was done in December so the maintenance expenses won’t show up until I run the books for December.)

Up: Billing back utilities

I shared in my original insider look that we bill back utilities to our tenants through a system called Ratio Utility Billing System (RUBS). Put simply, since the property doesn’t have split utilities, we get billed utilities, divide it based on number of tenants and square footage, and bill the tenants who pay us.

Doing this increases out cash-on-cash return by 9-10%. So, it’s a big win.

A lot of people may tell you that you can’t bill back utilities or that no one else in the market does it. Our real estate investor agent actually told us this. But we didn’t have any issues finding tenants willing to do this. We got both tenants within a weekend of listing the units.

Don’t let limiting beliefs stop you!

Big Up: Investing in real estate

- Net worth increase of six figures with 1 property

- Monthly cash flow in our pockets

- Tax benefits

- Fulfillment from a side gig (you can start one too, use this list!)

- New hobby to share with my wife, family, and friends

I’ll keep sharing my real estate updates as we continue to look for a second property!

If you are looking for an introduction to real estate investing, check out my course, Graduating to Success, which contains a FREE 8-part bonus module on real estate investing for physicians!

What do you think? Have you invested in real estate? What is your experience? Wins? Losses? A bit of both? I’d love to hear about it in the comments below!

Enjoyed what you read? Make sure to sign up for our mailing list in the comments below (under the comments)!

Great story and congrats on your rei. Did you advertise the utilities would be paid back? Do you charge a service fee to increase your cash flow for the utilities?

Hey Ashay, we just advertised that utilities were not included. We also included a description of our RUBS system in the lease that they signed. We don’t charge a service fee as this is illegal in NYS at least. We just charge back exactly what the utilities were after splitting them up via the RUBS equation!

Looks like you nailed this one. The forced appreciation is a big win and your ability to self manage has increased your COC. Having a COC of 20% plus while self managing increases your cash flow while allowing you an out later if you want to pass management back to a PM. If you decided to hire a PM you would still have a 10% COC. Nice ??. I am self managing my STR with the same strategy. Great job and I look forward to hearing more about your real estate journey.

Thanks Ian! I love following your journey as well!

Are you considering REPS? (real estate professional status) I’ve been batting around the idea for a while.

Yes! The plan is for my wife to obtain our EPS status in 2021. We are obviously currently working on this very hard and will keep you posted through the blog!