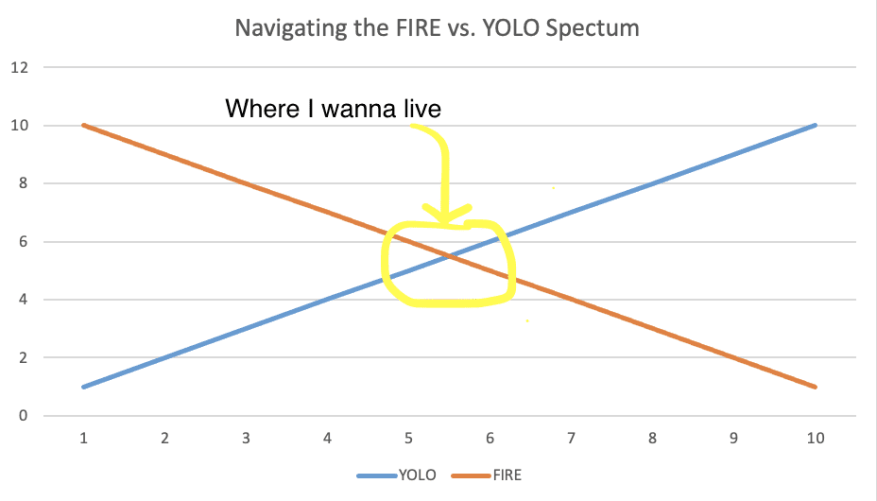

Before I begin, please let me be the first to say that I have not found the perfect balance between FIRE and YOLO.

I’m still working on it. But honestly, I think I do have a pretty good grip on it. I’m at least toying around near the right intersection between the two philosophies.

What I am very confident in, however, is that finding this balance between FIRE and YOLO is super, super important.

First, some background

My guess is that most of you are aware of these seemingly opposite personal finance philosophies of YOLO and FIRE. But, let’s just spell them out so we are all on the same page.

FIRE is the Financial Independence Retire Early philosophy. Basically it is the group of people working to reach that point where they don’t have to work anymore. There is a ton of debate about the Retire Early portion of this moniker. But I don’t really get hung up on that. I seek FIRE to follow my passions as a plastic surgeon on my terms because I want to, not because I have to.

YOLO is a bit of the antithesis. You Only Live Once. You can’t take money with you when you die. So buy the Tesla even though you have over $400K in student debt. Get the huge house. Basically, just YOLO.

The problem with the extremes

Like most things in life, both of these philosophies have some merit.

But the merit is found somewhere in the middle, not at the extremes. Let’s examine.

Take FIRE to the extreme

Save 75% of your doctor income, which averages around $200-250K in the United States. Live in a meager apartment. Eat Ramen noodles every night. At age 37, you can retire and live this lifestyle on your nest egg alone. Congrats, you FIRE’ed!

But, is this really the goal? I say no. We also have to splurge and treat yo’ self sometimes.

Now let’s take a peek at the flip side…YOLO lyfe

Your income is in the top 1-2% of everyone in the world.

Live. it. up. Buy the huge house for $1.5 million. Don’t save up for retirement, there’s time for that when you’re older…or dead. Just like paying back loans…that’s a future you problem. Sushi every night baby. That’s the motto.

Ughhhh…wait a second. Now you’re 60. You’re tired of your job. But you still have a ton of debt. And you need to keep making mortgage payments. And payments on the jet ski…even though you live in Cleveland. Welp, you can’t retire. You can either significant reduce your lifestyle or you can keep working til you die.

I don’t like either of those options.

Where is the balance with FIRE & YOLO?

I hope at this point I’ve successfully demonstrated why one or the other of these philosophies is no bueno.

So the next logical question is, “Where is the balance?”

It’s not a simple question. And it will differ a bit for every person.

But I would say that the balance for the average person is for you and your family to enjoy life intentionally while taking action to be secure in a future that you control.

Yep. That’s a bunch of word salad. Means nothing.

Let’s get practical and find a FIRE balance

Ok, average physician. What’s the FIRE/YOLO balance.

Here it is:

- Save 20% of your income

- Invest that 20% according to your financial plan

- I recommend low cost broadly diversified index fund and/or cash flowing rental real estate

- Use the remaining 80% to enjoy your life with intention

- This means that you should buy things when the joy you receive from them are equal to or greater than the sticker price. You also need to be able to buy these things without debt and within the confines of your financial plan/goals.

Related post:

The 7 Step Basic Formula for Wealth as a Physician

In that sense, it is really not that difficult at all.

Tailor it to your goals

Now, everyone is going to be unique and different. That’s why it’s important to set your financial goals as a first step in determining your financial plan.

That’s what Selenid and I did.

We created our financial goals. Then we set our budget and savings rate. Then we came up with our investment strategy. This comprises our financial plan. You can find the whole thing using the link below.

Related Post:

Still Need a Written Personal Financial Plan? Here…Use Mine!

We know that we will reach our goals if we follow our plan. So we have no guilt or worry about spending the money that we have ear marked to spend. We buy things intentionally and enjoy the heck out of them.

That’s a big reason why we felt so confident buying our first home instead of renting, which is the more generalizable advice that I usually give.

Related Post:

Rent or Mortgage Your First Home? [Why I Didn’t Follow My Own Advice]

It’s a spectrum

Some of you may want to save more and reach financial independence sooner. Fine, your balance will be a bit more along the FIRE side of the spectrum.

Some of you may want to enjoy the finer things a bit more up front and are okay with the prospect of working longer or having to save more later. Cool. You will be more along the YOLO side of the spectrum.

It’s all gucci as long as you know you are meeting your goals.

But, you have to make sure that you have thought out your goals!

Where do I fall on the spectrum?

I think I’m near the sweet spot in the YOLO FIRE balance. But I’m not quite there.

Honestly, I probably lean a little bit too far to the FIRE side. It’s natural probably given that my financial journey began with significant burnout that was largely attributed to a lack of financial well-being. I don’t want to experience that again.

But it’s also a bit natural for me as a person. I have a tendency to focus too much on a goal (any goal) at the detriment of enjoying the moment.

But this is why it is so important and awesome to have a great accountability partner. In my case, it’s my wife Selenid. She keeps me in the moment when I get too far sighted.

So thanks to her and my ever improving mindset, I become more centered every day.

But, most importantly, we do spend intentionally with a focus on experiences that increase our joy and helps us to really enjoy the present. But we also save and invest enough to reach our financial goals on time (in fact, in most cases so far, it has been ahead of time.)

We take that as a win!

So, how can you determine your balance along the FIRE and YOLO spectrum?

- Learn the basic formula to build wealth as a physician,

- Practice the 7 simple habits that will make you rich, and

- Develop your own personal written financial plan!

What do you think? Is FIRE and YOLO a spectrum? Where is your balance between the two? Let me know in the comments below!

Like the blog? Don’t forget to sign up for our newsletter mailing list below (under the comments) or to join our Facebook group of like-minded individuals on the path to financial well-being!

Great post, thanks!

We are writing our financial plan / investment policy statement right now and using yours as a template. I’m getting tripped up a bit about the the arbitrariness of the exact allocation. e.g. I really can’t pretend to have any precision on whether I think the bond allocation should be 5%, 10%, or 15%. Or whether international should be 20%, 30,% or 40% of the stock amount. Or whether we should rebalance semiannually or annually. Or with bands of 5%.

But perfect is the enemy of good. And I get that my making an arbitrary allocation decision now is probably better than my making continual arbitrary allocation decisions in the future after large market moves as, at best, i’ll waste time, and, at worst, i could accidentally start to return chase and impair the results if I don’t have an anchor to reference..

Hey Tom! You are exactly right. Some of it can seem totally arbitrary. And soon, I’ll be releasing my updated financial plan. Not much has changed but remember, it’s a dynamic plan. The important thing is to build in a grace period before any changes – ours is 3 months. That way it’s based on reason, not emotion!

Hey Tom I think the most important decision is the bond allocation. How would you feel going through a bear market like last year and lose half your money? For myself I thought it was awesome that I actually lost $30,000 of my portfolio last year because I knew it meant stocks were on sale. But some people look at this emotionally and look at $30,000 loss freak out and sell. Because I found my true risk tolerance I went from 80 stock/20 bond to 100%stock. I am now a rich man! If this is your first time investing aim for a higher bond allocation.

All the other decisions about how much international, band vs time based rebalancing, are not as big a deal at all.

PPS,

This is a great topic and I don’t think it gets discussed enough. There is so much focus on FIRE and often the details of FIRE are left out. One can achieve FIRE pretty quickly by completely downgrading their lifestyle just like you pointed out. Bloggers are pretty upfront about that but they often leave out the part that you probably need to maintain that lifestyle to continue to be financially free. I completely agree with your strategy and with the MoFIRE game plan of the The Darwinian Doctor. Buying a house was a great idea. Your readers know you bought a house while still being able to save. Lauren and I did the same thing and have gained over 600k in equity. We also decided to “enjoy our journey to financial freedom” and bought an STR for 50k down that just appraised at 900k for a 400k equity gain…. we still have our student loans…. if we had decided to rent until our 500k of student loans were paid off we would have missed both opportunities and lost out on 1million of wealth growth…. that would be 500k of wealth building minus the student loan debt…. plus we were able to enjoy both places 😉 you are on the right path. Keep up the great work.

I was listening to a podcast today where the guests discussed this exact concept! They emphasized the need to enjoy the journey as much as the destination. I think we’re all on the same page here about this. It’s a pretty tough balance, though. The Dr-ess and I save a lot, but I still wince when I see the check from our date nights.