It's been a little over a year since I've shared a net worth update so I figure it is time to share our progress. The last time we checked in, Selenid and I found out that we were officially physician millionaires! Which was great. But, as we all know, $1 million isn't what it used to be. So we still have a ways to go.

So let's dive in to this inside look at our net worth progress…

• Most doctors pay more in taxes than they need to. It’s not about being careless. It’s that no one ever shows us how to do it differently.

• I’m hosting a free session with Earned to talk through the most common mistakes doctors make and how to avoid them.

• We’ll go over practical ways to lower your tax bill and make sure your money is working for you.

• It’s on Thursday, October 16th at 8PM ET / 5PM PT if you want to join.

The rules of the net worth game

First let’s make sure we are all on the same page.

Net worth is the measurement of your wealth. It is the rules of the game of personal finance. Understanding net worth therefore teaches you the rules of the game and lets you start playing…and winning.

What then, is net worth?

In very simple terms, net worth is equal to your assets minus your liabilities. So then, what are assets and liabilities? Many definitions of assets and liabilities exist including some that are unnecessarily long and complicated. Simply put, assets are anything you own that put money in your pocket. This includes things like stock or bond investments and cash-flowing real estate. Conversely, liabilities are anything that takes money out of your pocket. The most common liabilities are debt and non-cash-flowing real estate like our primary homes.

Net Worth = Assets (Put Money in your Pocket) – Liabilities (Take Money Out of your Pocket)

Again, what is interesting to note in this calculation of net worth is that your income does not come into play. You will not find income listed anywhere on any net worth calculator.

So, this equation teaches us how to calculate our current net worth. Thus, we have an accurate measurement of current wealth.

Our net worth trend

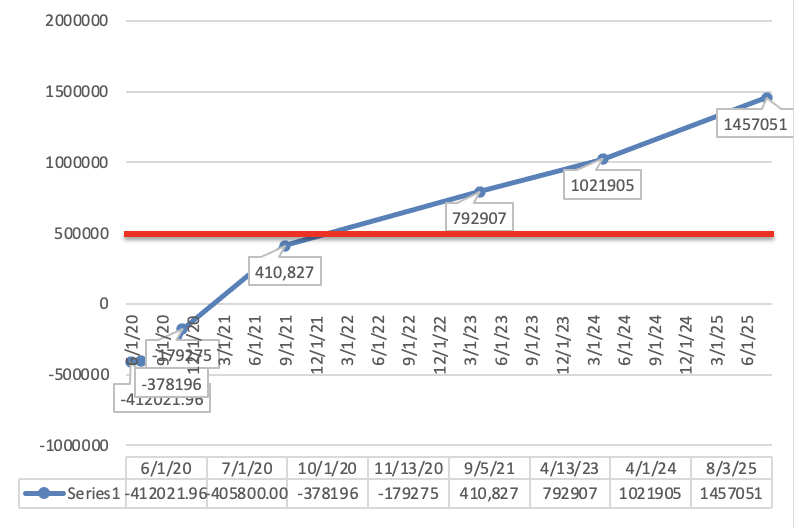

At last check, our net worth was $1,021,905 in April 2024 which was an ~$250k increase from the previous check. And before that, we crossed the “0-line” to go from negative to positive. So seeing these additional increases has been amazing track.

It has also served as an illustration and great reminder that creating and following simple, healthy financial habits really makes a HUGE difference.

Related Post:

The Simple Habits That Will Make You Financially Successful

That’s even the main reason that we track our net worth update. Remember, net worth is your personal finance scorecard. So by studying the scorecard, we can see what is helping and hurting us. Then, just do more of what helps and less or what hurts.

This is what actually got me started. Because just 5 years ago, we were in a huge financial hole

In fact, our financial situation at the end of my training is the worst I’ve seen.

And I mean that.

I have yet to meet someone starting off in a worse spot. And don’t get me wrong, I started off so bad 100% because of my own doing – poor financial decisions and even less knowledge. I was scared to learn and intimidated by my mistakes. More on that here.

Current net worth progress update!

As always, I promise to be totally transparent!

Let’s first look at my net worth trajectory since I started tracking it in June 2020 at the end of my training and the beginning of my financial education.

Let’s hit some of the major points:

1. Yikes, when I first started tracking my net worth update, things were bleak. In fact, this doesn’t include when I first, first did a rough check in Spring 2020 and it was >-$520k. I hated seeing these numbers. But it gave me a starting point so I could work to make them better.

Moral of the story? Personal finance is scary at the beginning. But looking the big bad monster in the face is the best thing you can do! You’ll realize it actually isn’t as scary and difficult as you thought and can start making positive changes!

2. You can see that I increased my net worth by a large amount before I even received my first attending paycheck in mid-August 2020.

Here’s how.

I point this out to show that no matter your situation, you can improve your net worth. Even if you are not looking at a big increase in pay like I was going from a trainee to an attending.

In fact, here are 5 steps to increase your net worth right now.

3. From October 2020 to November 2020, this is a big jump in net worth. This happened after we bought our first investment property and forced appreciation on it.

I always say that real estate in a wealth accelerator. This is proof. More on that property and its cash flow here.

Related Post:

A Physician’s Guide to Real Estate Investing

4. After that, a looonnngggg break before another net worth update check.

But after that last check in September 2020, we crossed the fabled red line of $0 net worth and got into the positive!

5. Next was another $300,000+ increase in net worth by following our written financial plan.

You will notice that the slope of the line did flatten out a bit (nerd alert!). This is bound to happen from time to time. The economy has stalled. We have been mired in a bear-type market. But this really doesn’t matter. We were on a steady pace. And more importantly, we are well on way to meet our financial goals and don’t need to stress!

6. After another year, our net worth jumped another $400k. We will dive into the exact make up of our net worth calculations next but it was so encouraging to see compound interest working in our favor over time.

Let’s dive deeper into this most recent net worth progress update of a physician millionaire

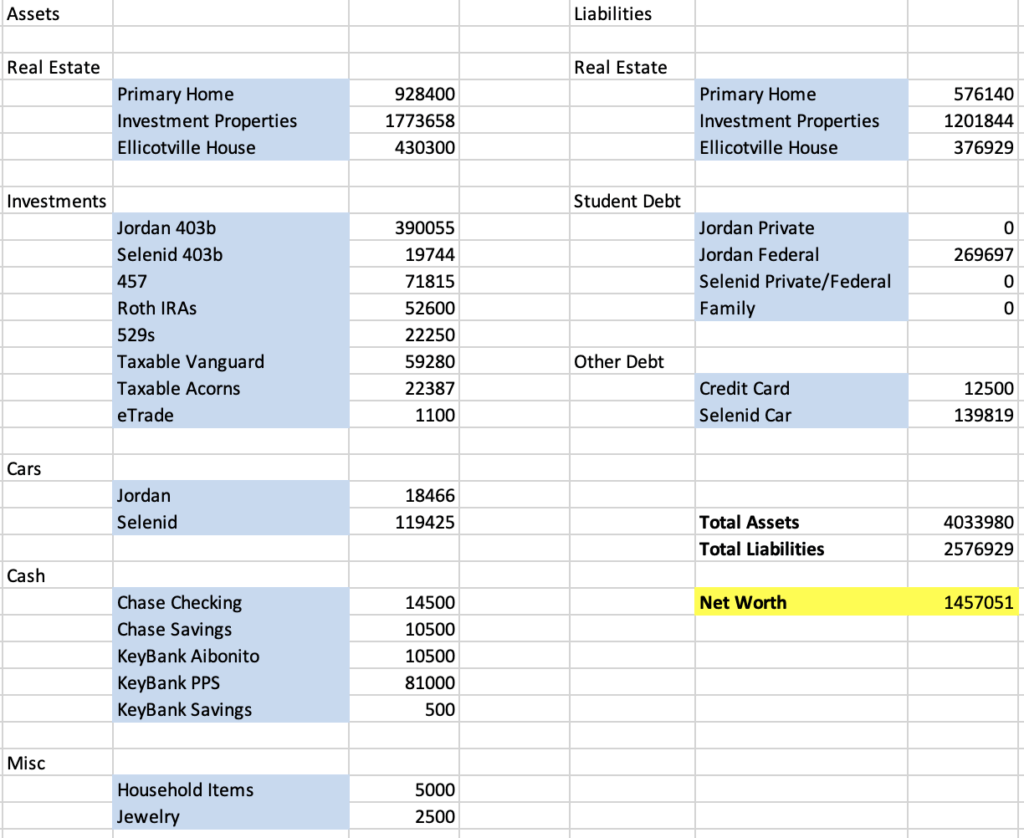

Here are my assets and liabilities:

Some of these numbers are obviously estimates, like our household items. I kept this on the conservative side. I even dropped the estimate down from the previous net worth update.

Also, this is a snap shot in time. That’s our cash and savings at that moment. Also at that moment, we had $12,000 on a credit card that we will pay off completely at the end of the month.

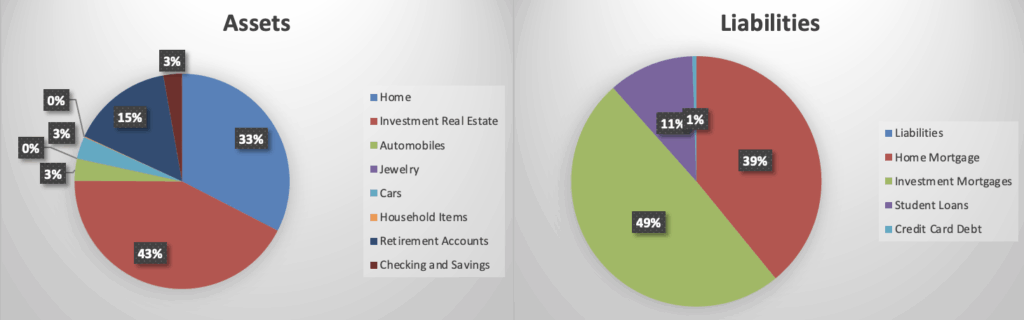

Here are graph formats showing the same information:

The key to building wealth and becoming a physician millionaire is to maximize assets and minimize liabilities. Let’s see how we are doing…

Let’s start with assets

Our biggest assets are our primary home and our investment properties.

Now I know, I am totally on the side of saying that your primary home is not an asset. And we don’t treat it that way. But we do include it in our net worth calculations.

Investment properties on the other hand.

They have made a HUGE impact on our assets. Cash flow and forced appreciation resulted in home value gains of near $100,000 for at least 3 properties. However, we don’t even count the forced appreciation values in our net worth calculations. We just include the market values. We would rather under than overestimate. Either way, real estate investing has been the single biggest positive influence on our net worth.

And this doesn’t even count the tax benefits.

Here are insider looks (with full numbers) of investment properties #1, #2, and #3.

Retirement savings continues to grow into a bigger and bigger proportion of our wealth which is a great demonstration of how compound interest has been working in our favor over these 5 years. They now represent 15% of our wealth. This is up from 11% at last check. And it's is a huge improvement over the previous 7% and then 4% and 0% before that.

Related Post:

5 Reasons You Need to Max Out Your 401k

The rest are relatively small potatoes.

Moving on to liabilities

Again, our biggest liabilities are the mortgages on our primary home and our investment properties.

But…

Notice that our primary home is about a wash when comparing our assets and liabilities. It counts as 33% of our assets and 39% of our liabilities.

I also think it is interesting that our investment properties’ value equals 43% of our assets and their debt equals 49% of our liabilities. This is obviously a percentage and relative. And the asset portion pays us cash flow each moths as well. But interesting still.

Lastly, student loans remains a big part of my liabilities. However, they are a much smaller percentage (15%) than previously as we continue to pay them down aggressively. Each month, we pay huge amounts from our 43-50% savings rate to pay off my student loans. Each $1 we pay off is $1 that our net worth increases. Here’s my debt pay off strategy. Plus, in 4 months, my federal loans are scheduled to be forgiven via PSLF.

One *tiny* addition

The keen observer here will however see a brand new liability compared to our last check. And that is an automobile loan – a big no-no in the personal finance world.

Well, I've shared how we bought a brand new 2025 Cadillac Escalade to replace my old doctor car here. And yes, we did finance it to start. Why? Well, it allowed us save the lump sum cash payment to invest in a new rental property. And we plan to pay it off aggressively.

But this did sink our net worth a bit as the car lost about 1/3 of its value as soon as we drove it off the lot. But guess what? This is another perfect example of an intentional spend. We still are on track (ahead of time) to meet our financial goals and it brings us a huge amount of joy greater than the price tag.

How our net worth progress compares to what it should be

I go in depth about how to calculate your expected net worth here.

Based on that formula, my expected net worth is in the range of $650,000. So, we are doing really well at greater than $800,000 more than expected net worth!

I fully attribute this growth to a few things:

- Learning how the wealth building game works,

- Committing to the small financial habits that create big wins, and

- All of you in the PPS community who teach and inspire me and keep my accountable!

But what does this actually mean?

Remember what I shared before? When I calculated this and told Selenid that we were millionaires, she just laughed. Her exact words after were, “Well, it doesn’t feel like that!”

And it doesn’t. As a physician millionaire, I don’t feel all that different from before.

We still budget. We don’t splurge much. I have massive student debt still. At times we feel cash poor if we have a month with a lot of expenses.

It’s not like we imaged when we were kids and thought of being a millionaire.

And this could be a problem. Because it’s an arrival fallacy…

If we had told ourselves that we would be happy or everything would be find when our net worth was >$1 million and I was a physician millionaire, this accomplishment would feel very hollow. Because it would not have met our expectations. And that is exactly what an arrival fallacy is. And this happens way too often to doctors…

Thankfully, however, that’s not what happened with us. Very little tangibly changed now that we are millionaires. But we didn’t expect it to. Our written financial plan calls for us to reach financial freedom in 20+ years. And our goal nest egg is $5 million, not $1.5 million.

Plus we have a very strong “why” for achieving financial freedom. The goal is not monetary, but rather experiential. The money will give us our time back.

In fact, looking at our written financial plan, our goal was to become millionaires in 2033. So we are way ahead of schedule! Rather than an arrival fallacy, this exercise helped motivate us to keep going!

The bottom line

Checking your net worth progress helps.

You can analyze and see what you are doing. You can pick out the things that are making it better. And choose to do more of those things.

You can also pick out the things that are making it worse. And choose to do less of those things.

It is not an end-all, be-all figure. And certainly not a goal in and of itself. But it does help as you follow your “big why” to financial freedom!

Here are the major take-aways:

- Calculate your net worth – it’s your personal finance scorecard (there are tons of online calculators to use)

- Review/analyze your net worth at least a couple times a year

- Maximize your assets (things that put money in your pocket)

- Minimize your liabilities (things that take money out of your pocket)

- Create and follow your financial plan so you can put things on auto pilot and enjoy your life! (Use my template here to create your own.)

And for a one stop resource to start or optimize your path to financial freedom, check out my best-selling book, Money Matters in Medicine!

What do you think? Have you ever checked your net worth? Are you a physician millionaire? Do you update your net worth progress regularly? Is becoming a physician millionaire a new arrival fallacy? Let me know in the comments below!

4 Responses

Congrats they say the first 100K , then $1M is the hardest to achieve. No question that is true.

All your hardwork is starting pay off.

I have to say as a former real estate investor, stock is way WAY better. SP500 index alone = similar returns as real estate for far less work. but given we are doctors, we want to beat the market. It takes a lot of study and research but I think it’s possible to beat the market but I do think it takes a bit longer to get “good” and markets are very volatile by far – so it does take a temperament and mindset that is different than in real estate. Given how risk averse many doctors are, I guess not many have that mindset.

Anyway good luck to you.

Thanks for the kind words and sharing in the journey! I definitely love index fund investing. I do think real estate requires a lot more work but so far in my experience that work is rewarded. But has to be done right. Even passive real estate investing requires active work in the form of due diligence!

I applaud your diligence. I too believe you will accelerate your wealth quest with stocks.

If you put 1/10 the time into stock research that you put into real estate, you can bypass index investments and pick a few stocks to hold for decades (AAPL, NVDA, BRKA etc)

I’ve held all of these for 10-20 years and the tax burden is close to 0! (Until you sell).

It’s interesting, my stock research has just made me more steadfast in my belief in index funds! I feel like I cannot pick the few “right” stocks with any degree of consistency. How do you choose your stocks?